New data from the Small Business Payments Alliance once again reaffirms the value of credit cards for small businesses. According to consumer surveys and research gathered over the first quarter of 2024, credit cards continue to provide crucial benefits to small businesses. Access to credit cards helps these businesses lower their operating costs and finance major purchases, such as travel, inventory, and accommodations. Rewards programs, such as cash back, give small businesses access to funds they can then use to re-invest in their businesses or give back to their employees. Customers also benefit from secure and efficient transactions, including enhanced fraud protections. Credit cards are an essential part of doing business in a modern payment ecosystem and provide key rewards to customers.

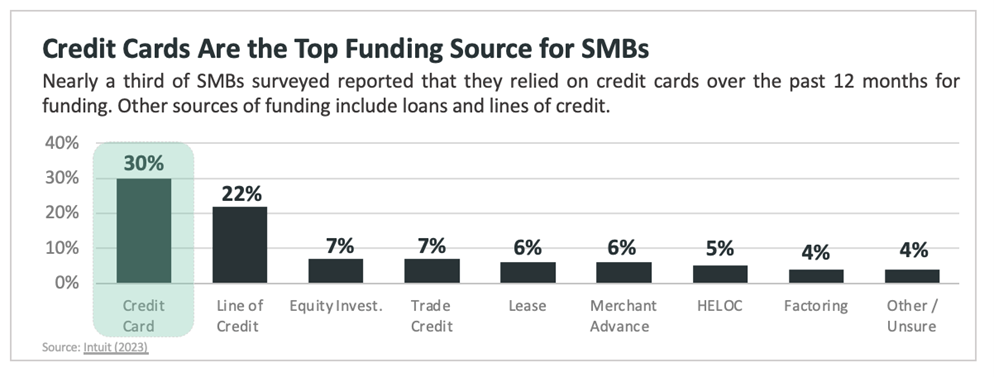

Credit Cards Are Top Funding Source for Small Businesses

Credit cards are a valuable source of financing for small and medium-sized businesses (SMBs). Numerous surveys have found that credit cards, particularly those offering rewards, are consistently ranked as SMBs’ top source of funding, above other resources such as lines of credit, BNPL, or loans.

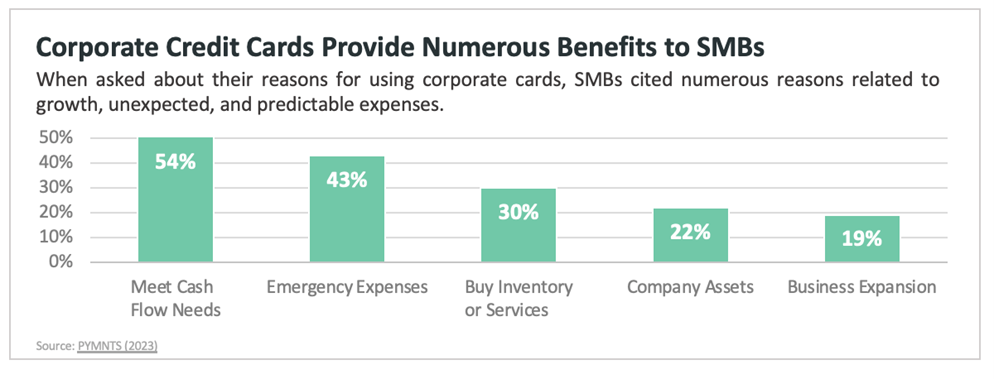

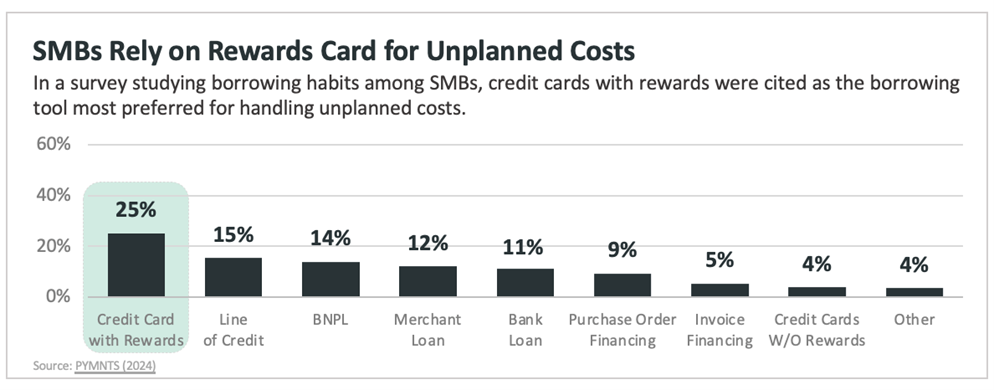

Small Businesses Rely on Credit Card Rewards for Unplanned Costs

SMBs use credit cards to handle both predicted and unexpected expenses. According to a survey from PYMNTS, credit cards help small businesses pay for usual expenses (e.g., buying inventory) as well as unplanned costs (e.g., receivable shortfalls), all in the name of fueling business growth.

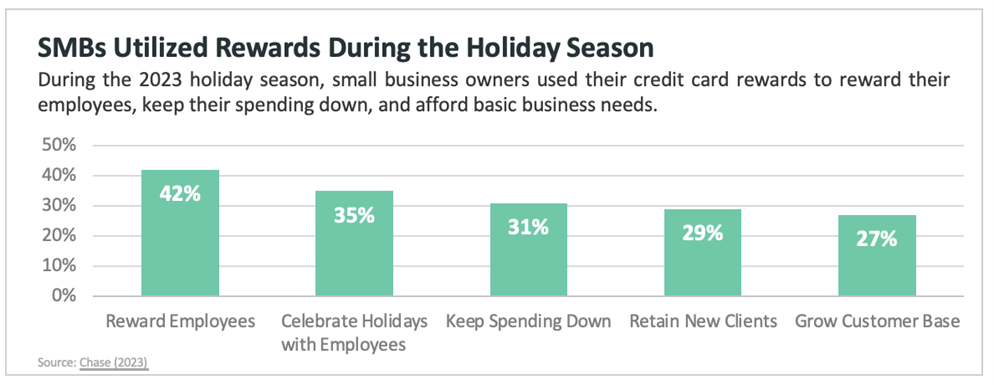

Credit Cards Help Small Businesses During the Holiday Season

Small business owners used their credit card rewards programs to help themselves and their employees during the 2023 holiday season. Rewards points were used for employee benefits, keeping spending down, and growing and retaining consumer/client bases.

Small Businesses Earn Greater Income When Customers Use Credit Cards

Credit card transactions guarantee payment and avoid the costs and risks associated with cash (such as errors in counting, storing, transporting, and safeguarding). Credit cards also create opportunities for small businesses by granting access to e-commerce and mobile commerce channels, which are growing rapidly as more and more customers take advantage of online purchasing.

Conclusion

Once again, data affirms the value of credit cards for small businesses. Credit cards remain a top funding source for small and medium-sized businesses; small businesses rely on credit card rewards to pay for unplanned costs; and credit cards help small businesses during the holiday season. Small business owners need the security and reliability of credit cards – not government mandates that would weaken the modern electronic payments system.