Small businesses are the backbone of New Jersey’s economy. New Jersey’s more than 952,000 small businesses employ 1.9 million New Jersey residents – nearly 49 percent of the state’s private sector workforce. Small businesses in New Jersey rely on credit cards and rewards to lower operating costs, re-invest in their businesses and employees, manage cash flow, and give customers more choice, security, and convenience in how they pay. In fact, a survey conducted by the Federal Reserve found that small businesses that start accepting credit card payments see a 10% – 15% increase in the size of average transactions. The modern, safe, and secure payments ecosystem is critical to the success of small businesses throughout New Jersey.

Bill Sponsors Push for Hearing on New Credit Card Mandates Impacting Small Business

The Durbin-Marshall credit card bill was introduced last year in Congress as the “Credit Card Competition Act” (CCCA), and the bill’s sponsors are now pushing to hold a hearing. The proposed legislation is a direct threat to the electronic payments and rewards system and would have a major negative impact on local businesses, entrepreneurs, and tradespeople who use credit cards and rewards to run their businesses. It would circumvent the competitive market with a government “routing mandate” that dictates which processing networks banks can accept, without regard to security or quality.

Small Businesses Rely on Credit Cards

Credit card payments provide small businesses with many critical benefits: they enable customer convenience, enhance transaction security, and provide billions in rewards that small businesses can reinvest in their operations. From facilitating quick and easy purchases to bolstering consumer confidence with robust security measures, credit cards are integral to the modern small business ecosystem. Rewards programs often serve as a crucial financial lifeline, helping to offset operational costs and maintain cash flow.

- In 2022, card issuers spent an estimated $100 billion on cash back, rewards, and other credit card benefit programs. (Javelin Strategy & Research, 2023)

- The Federal Reserve Bank of Boston found that the average cash transaction is $22, while average non-cash transaction is $112. When a merchant begins accepting card payments, they experience a 10-15% increase in average transaction size. (Federal Reserve Bank of Boston, 2017)

- Credit cards create opportunities for small businesses. They grant access to e commerce and mobile commerce channels, which are predicted to grow over 10% in 2023, and make up 24% of retail purchases by 2026. (Forbes, 2023)

- 87% of new small business owners said that access to electronic payment options was important to their decision to launch. Additionally, access to electronic payments tied for first (68%) as the most important tool or technology in starting a new business. (SBE Council, 2022)

Durbin-Marshall: Unintended Consequences of Bad Policy

The Durbin-Marshall credit card bill would be a windfall for corporate mega stores, with benefits focused on only a few corporations. The new mandates would dramatically reduce credit card rewards; compromise fraud protection and cybersecurity; and reduce access to capital and credit for many small businesses.

- The bill would “disproportionately benefit the top five businesses in the U.S.” and “almost all of those savings will accrue to retailers with $500 million or more in annual sales, with little going to small businesses.” (Finance Department Chair, University of Miami’s Herbert Business School)

- The bill would cost small businesses “over $1 billion in lost rewards as well as a decline in access to credit.” (Finance Department Chair, University of Miami’s Herbert Business School)

- Forcing banks to open up credit cards to alternative payment processing networks puts financial data at risk because not all payment processing networks have the same security provisions. In fact, many skimp on benefits such as fraud protection and security features to prevent data breaches. (Bankrate, 2023)

- In 2021, economists reported that extending the Durbin Rule to credit cards could cause annual revenue losses of $5 to $10 billion for community banks and local credit unions. (Morning Consult, 2021)

- Half of small businesses “are concerned that future credit card regulation could lead to lower credit limits and thus a negative impact on their businesses.” (Cornerstone Advisors, 2023)

- Despite making up only 11.7% of the credit card population, lower-income and low credit households would lose $434 million, close to 22% of the cost borne by all consumers if the CCCA is enacted. (Amsterdam News, 2022)

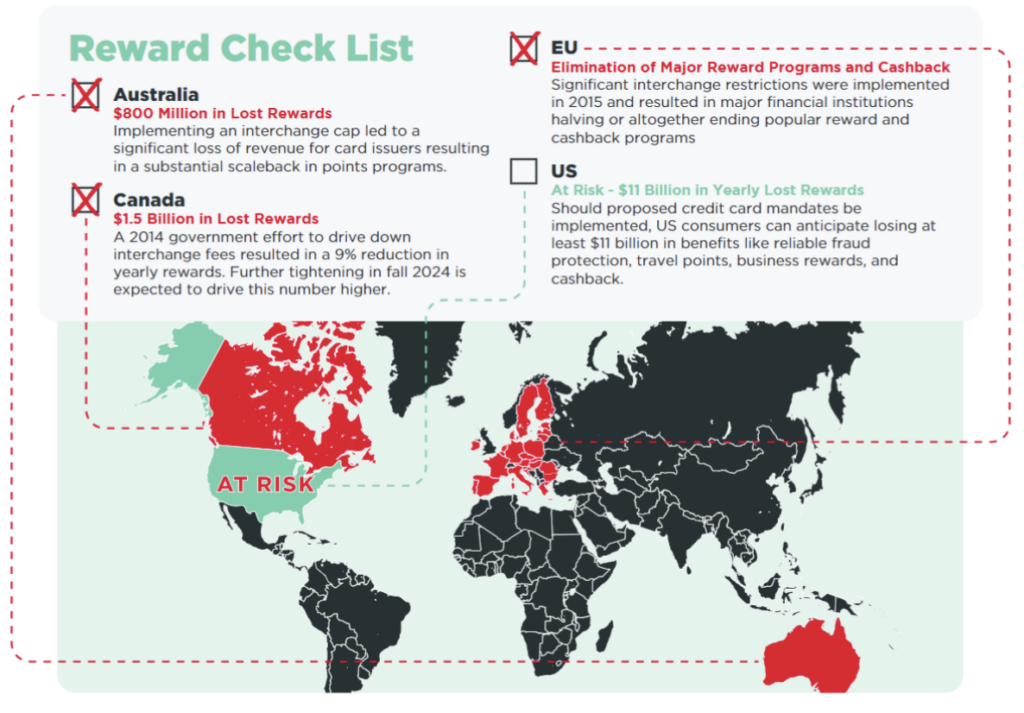

- Credit card interchange reductions that significantly reduced rewards programs in the European Union, Australia and Canada are a warning of what’s to come in the U.S. should CCCA become law. (International Center for Law & Economics)

Interchange Mandates Didn’t Work the Last Time They Tried It

You don’t have to look far for historical evidence of how Durbin-Marshall will negatively impact small businesses. In 2010, Congress passed a similar provision that forced price controls on

debit card processing. That legislation only increased big box retailer revenue, while studies show little to no cost savings were passed on to consumers or small businesses. Because many alternative payment processors charge a flat fee, savings never made their way to small businesses. Instead, small businesses and consumers saw reduced availability of free checking, higher monthly fees and minimum account balances – and the disappearance of debit card rewards programs.

- Customers did not see lower prices. According to the Federal Reserve Bank of Richmond, 77 percent of retailers failed to lower prices and 21 percent actually increased prices after routing mandates went into effect. (Federal Reserve Bank of Richmond, 2014).

- Instead of saving money, the Durbin Amendment indirectly lost consumers between $22 and $25 billion. (University of Chicago, 2013)

- The independent Congressional Research Service, whose mission is to offer research and analysis to Congress, echoed an earlier report by the Richmond Federal Reserve noting that consumers failed to see any meaningful cost savings as a result of similar legislation imposing routing mandates and price caps on debit card interchange. (Congressional Research Service, December 2023)

- The Durbin Amendment had limited and unequal effects on merchants in terms of lowering costs for merchants. Averaging across 26 sectors, 89.9% of all merchants had experienced either no change in debit costs or had seen their debit costs increase under the new legislation. (Federal Reserve Bank of Richmond, 2015)

Conclusion

The Durbin-Marshall credit card bill would not benefit competition in a meaningful way, as only corporate mega stores with huge volumes of transactions would benefit from this proposal. With this drastic shift in the credit card market, rewards programs would be decimated and there would be an increased risk of fraud for local businesses, entrepreneurs, and consumers alike. Small businesses in Delaware shouldn’t be forced to pay for a Washington giveaway to corporate mega stores.