Small businesses across the country are increasingly leveraging credit card rewards as a strategic tool to stretch budgets, manage cash flow, and reinvest in growth. From cashback on everyday purchases to travel points and discounts on essential services, credit card rewards programs have evolved beyond consumer perks into valuable business resources. By maximizing rewards, small business owners can offset operating costs, improve purchasing power, and gain a competitive edge in an environment where every dollar counts.

Understanding how small businesses rely on rewards programs is critical as some in Congress are pushing for new mandates that could eliminate these programs. The Durbin-Marshall credit card mandates would impose federal routing mandates on small businesses that would weaken existing security and fraud protections while resulting in reduced access to credit and the elimination of credit card rewards.

Durbin Amendment Eliminated Debit Card Rewards Programs

You don’t have to look far for historical evidence of how Durbin-Marshall will negatively impact small businesses. In October 2010, Congress passed a similar provision that forced price controls on debit card processing. As a direct result of the Durbin Amendment, small businesses and consumers saw reduced availability of free checking, higher monthly fees and minimum account balances – and the disappearance of debit card rewards programs.

- Customers did not see lower prices. According to the Federal Reserve Bank of Richmond, 77 percent of retailers failed to lower prices and 21 percent actually increased prices after routing mandates went into effect. (Federal Reserve Bank of Richmond, 2014). Meanwhile, a University of Chicago report found that instead of saving money, the Durbin Amendment indirectly lost consumers between $22 and $25 billion. (University of Chicago, 2013)

- In 2011, a study found that the availability of debit card rewards fell 30% in the year following the implementation of the Durbin Amendment. (Bankrate, 2011)

- Post-amendment, “the average interchange fee for a $5 purchase doubled from $0.11 to $0.23 for small-ticket transactions.” (Justt, 2021)

Small Businesses Use Rewards to Offset Operating Costs

Many small businesses use credit card rewards to earn cash back on recurring expenses such as office supplies, utilities, fuel, advertising, and shipping. These savings are often reinvested into the business or used to cover other operating costs.

- 80% of small businesses use credit cards that have rewards programs – and 73% of those businesses use the rewards or cashback for business purposes. (Visa Small Business Pulse, 2024)

- Small businesses carry an average of $13,000 per month in credit card expenses. A large share of that spending is in categories that can generate rewards which reduce overall costs. (J.D. Power 2024 U.S. Small Business Credit Card Satisfaction Study)

- Small businesses often use credit cards for fixed recurring expenses (e.g., utilities, supplies, etc.), so even modest reward rates can add up to substantial savings over time. For example, a business spending $2,000 monthly in office supplies, phone and internet at 5% cash back could gain $1,200 annually, just from those categories. (Monefy, 2025)

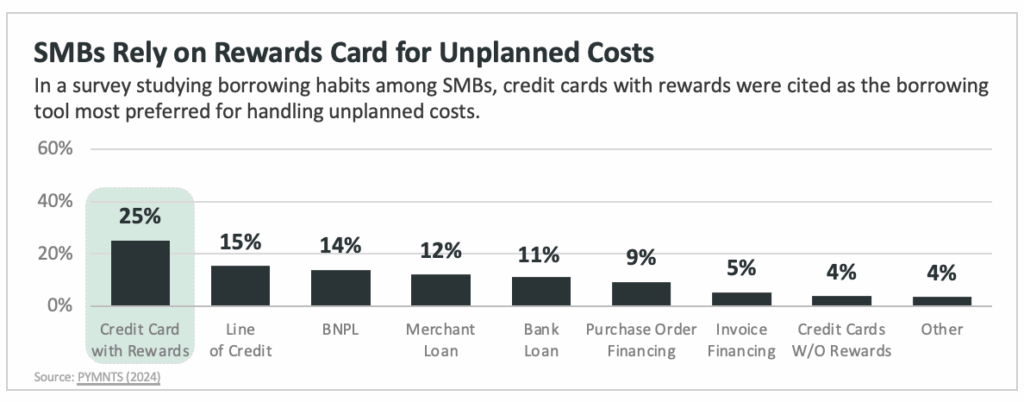

Small Businesses Rely on Credit Card Rewards for Unplanned Costs

SMBs use credit cards to handle both predicted and unexpected expenses. According to a survey from PYMNTS, credit cards help small businesses pay for usual expenses (e.g., buying inventory) as well as unplanned costs (e.g., receivable shortfalls), all in the name of fueling business growth.

Small Businesses Use Rewards Programs to Offset Travel Expenses

Small businesses frequently utilize credit card rewards to offset travel expenses, enhancing their ability to attend conferences, meet clients, and manage business-related travel costs efficiently. By leveraging travel rewards programs, these businesses can reduce out-of-pocket expenses and streamline their travel planning.

- SBPA members frequently use rewards points to cover business trips for events and conferences.

- SBPA members use rewards points to offer free travel for employees – frequently as a perk or performance-based incentive. In one instance, a small business owner used points to pay for a cross-country plane ticket so an employee could attend the funeral of a loved one.

Unintended Consequences of Bad Policy

Durbin-style regulations have been tried in other countries, resulting in significant reductions of most credit card rewards programs.

- Credit card interchange reductions that significantly reduced rewards programs in the European Union, Australia and Canada are a warning of what’s to come in the U.S. should CCCA become law. (International Center for Law & Economics)

- In Australia after the Reserve Bank added Durbin Amendment-style regulations to credit that limited interchange fees, the value of rewards points fell nearly 25%. (CRA International)

Federal Mandates Will Not Help Small Businesses

A recent study found that Durbin-Marshall credit card mandates would “disproportionately benefit the top five businesses in the U.S.” and that any proposed changes to the payment routing system “is demonstrably a favor to large—not small business.”

The report, “Imposing Alternative Payment Networks on Credit Cards Will Likely Hurt Low Income Households and Small Merchants,” from the Chair of the Finance Department at the University of Miami’s Herbert Business School, found that:

- Savings from federal mandates would “accrue to retailers with $500 million or more in annual sales, with little going to small businesses.”

- Small business owners “receive roughly $12 billion in credit card rewards when they make purchases on credit themselves, which constitutes roughly one-tenth of all credit card rewards.” Durbin-Marshall would result in the reduction of credit card rewards programs, “costing small businesses over $1 billion in lost rewards as well as a decline in access to credit.”

Conclusion

The Durbin-Marshall credit card bill would lead directly to the elimination of credit card rewards programs – just as the October 2010 Durbin Amendment on debit cards led to the elimination of debit card rewards programs. For small businesses working hard to be successful, these programs are much more than frivolous perks – they are strategic resources that enable businesses to stretch limited budgets, invest in their operations, and respond to market challenges with greater flexibility. Preserving rewards programs ensures that small business owners continue to have access to the financial tools necessary to thrive, support local economies, and sustain the jobs and communities that depend on them.